Technology

Machine Learning Tools Increase Power of Hypothesis Testing

All the researches commence with the hypothesis. Without the hypothesis, there can be no research or experiments. All the results extracted from the sample is subjected to statistical tools for obtaining the results. The hypothesis is the assumption and can be of two types. It can be a null hypothesis or an alternative hypothesis. The research’s main purpose is to gather the data from the population and then perform calculations on it to figure out the acceptance or rejection of the hypothesis. Critical values calculator is one of the most beneficial tools for statisticians. It helps in determining the results with the perfect implication of statistical tools.

Hypothesis Testing:

The scientist can make any kind of hypothesis and start testing it to determine the truth. The most widely used statistical method to determine the reality for the assumption is known as hypothesis testing. It can be any hypothesis like does the change in web background lead to better organic traffic and ranking? Do the people with hypertension suffer from more hair fall? Does human height is affected by insomnia? The most common hypothesis testing applied to such assumptions is A/B testing. Hypothesis testing includes the experimentation on the subjects and then compiling the data. Critical values calculator is the digital approach that intends to find the critical values for both one-tailed test and two-tailed test.

Machine Learning Tools:

No doubt, the machine learning tools have optimized the speed and accuracy of determining the truth of the hypothesis. The tiredness and hectic task of applying statistical tools and calculating the results have become much easier with machine learning tools. It has brought amazing relaxation in hypothesis testing. Critical values calculator proves to be the main source and deciding factor for determining either null hypothesis would be rejected or accepted. All hypothesis has probability which is known as p-value.

According to the Alpha Investing rules, it is essential to adjust p-values for multiple hypotheses when subjected to test simultaneously. It is necessary to reduce the false discovery rate. Critical values calculator helps in find the p-value for the given sample data.

Accuracy of Results:

Adjusting the p-value appropriately and wisely is necessary. Some of the times, the p-value is chosen for the hypothesis enhances the likelihood of rejecting the hypothesis. In contrast, it may even reflect more chances of hypothesis acceptance due to inappropriately adjusted p-value. Z critical value calculator intends to apply on population’s mean through performing a one-sample Z-test. Z-test can be of two includes such as one-tailed Z-test and two-tailed Z-test. The best method is the use of the function for making the final adjustment for the p-value. It is dependent on the results of the previous hypothesis and provides guidance. A critical value calculator is available and can be accessible for research purposes at any time. One of the major difficulties with research work is the result section. The chances of losing the data and any manipulation are avoided when statistical tools are applied timely. Find the critical values of z & t to determine the results of the experimental data. The machine learning tools ensure to kick out the delays in calculations and maximize the institute’s researches.

Technology

AI and data technology transforming the insurance industry

The insurance sector is based on huge risks as insurance providers depend on their aptitude of predicting what risk an individual, company, or business shows. They need a lot of information and customer data to make informed and accurate predictions. This is where AI and data technology come in handy to help them analyze available data to make fertile decisions. It also helps them boost revenues ultimately. Insurance providers can benefit from technologies like artificial intelligence and big data by integrating them into their work processes.

Here is how data technology and AI will transform the insurance industry.

Behavioral premium pricing

Telematics and wearables are live examples of how technology has changed the way insurance companies work. These devices and tools can collect customer information effectively and generate a huge amount of data that companies can use to offer them affordable behavioral premiums balance transfer. For instance, insurance providers can install devices in vehicles to collect useful data and information about how a customer drives, the speed they go on average, and how they use breaks in case of over speeding. All the available information can be used by companies to create a customer profile as a driver so they can guess how much risk he can cause for the company. The wearable tools are not only used by auto insurance companies but life insurance companies are also investing in such tools to offer their customers enough coverage in case of a road accident.

Facial recognition

Believe it or not, insurance companies are also using facial recognition technology in their operations and processes. Experts say that facial recognition technology has not reached its potential in the insurance sector, but its uses in the industry are impressive. It is also said that insurance providers will be able to use FR technology to analyze facial patterns of their potential customers to anticipate signs of aging, life-threatening habits, and smoking, etc. to save a lot of money that they spend on several medical examinations.

AI interfaces and personalization

The modern day business landscape is all about providing consumers with an excellent experience that can last in their minds. Personalization is an integral part of a better customer experience. In old days, customers were offered by insurance companies with a limited set of offers and plans and they had to choose from the available options. But now insurance companies offer AI interfaces and personalization features to their customers so they can get enough coverage as per their individual needs and requirements even without paying higher premiums. For example, customers now can add life insurance riders into their basic plans to get more coverage as they need.

Faster claims

The major factor to figure out the efficiency of an insurance company is how faster it can manage to settle claims. Thankfully, AI and data technology have totally transformed the way insurance companies settle claims. AI integrated tools, online claim submission platforms, and data analytics can help insurance providers settle claims faster than ever before.

Decreased fraud occurrence

According to a report, fraudulent activities in the insurance sector are worth more than USD 80 billion. With help of artificial intelligence technology, it is very much easier and possible for insurance companies to collect useful data and customer information within a matter of moments. This not only supports them in settling claims faster than ever but also reduces the chances of fraud. Insurance companies that use AI and ML technologies to detect fraudulent activities, enjoy improved revenues, and grow their customer base effectively. As a result, they are better able to perform most of their operations and processes efficiently than companies still using traditional methods and approaches.

Final Verdict

The successful integration of technologies like artificial intelligence and big data into different insurance operations is the best way to improve the overall operational efficiency of your insurance company. These technology advances have changed the entire industry and insurance customers are super excited to experience all these innovative changes in operations. The quickly an insurance company accepts the technological changes and trends, the faster it will experience greater progress and growth.

How to

How is the Current Chip Shortage Affecting the Smartphone and Technology Industries ?

When looking at the technology industry, it’s easy to think that it will continue to grow exponentially. For instance, smartphone shipments will surpass 1.4 billion units in 2021, an increase of 12 percent from the previous year. That sounds promising, but there is also some bleaker news that production may be slowed down by a global chip shortage. What is this issue, and how will it affect the end-user?

What is the Chip Shortage?

Microchips aren’t just used to make smartphones, they’re a feature of pretty much any piece of modern technology. Indeed, semiconductor chips are among the world’s most precious resources. Because any product that needs power also needs a microchip, the demand for chips has grown alongside the increase in the production of technology.

The recent increased necessity of electronic items has pushed the need for microchips up. But, because the production of chips was halted during 2020, the chip manufacturers are now playing catch up. This has brought about shortages, meaning that not every company that needs chips will be able to get hold of them. It has also pushed the price up on the chips, which will then get passed down to devices that use them.

Old and Low Entry Smartphones are Still Relevant

Obviously, if device prices go up it spells bad news for consumers who want to keep up to date with the latest and best pieces of tech. However, it should be noted that old and low-entry smartphones are still able to perform a lot of the same functions as new ones. For example, the very popular mobile casino, Genesis Casino, can be accessed on any device post-2014, thanks to the rise of HTML5 and streaming.

This is good news, because online casino gaming is one of the most common forms of entertainment on smartphones. Developers now target the booming mobile audience as their primary demographic, knowing that a much greater proportion of players prefer the handheld device over desktop. That’s why games like Book of Dead look perfect on the mobile screen. The developers considered the portable specs first and made the game more immersive on the device.

Will This Slow Down Progression?

Aside from inflated prices on high-end pieces of technology, the main change that end-users will notice could be the slowing down of progression in the smartphone industry. Society has grown accustomed to seeing brand-new, revolutionary smartphone innovations on a yearly basis. Sometimes, from the major companies, they come even more frequently than this. The chip shortage could lead to a deceleration in these releases as the microchip manufacturers try to boost their production lines.

The chip shortage is likely to halt progression and raise the prices of high-end pieces of technology for the next few years. However, it isn’t all doom and gloom for consumers. They can still access their favourite forms of entertainment from lower-spec smartphones and should be able to wait out the storm.

-

Internet4 years ago

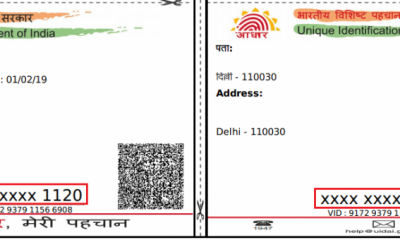

Internet4 years agoHow to Download a Copy of Your Aadhaar Card

-

Sports2 years ago

10Cric India Bookmaker Review for Betting on Sports Online in 2022

-

Apps4 years ago

Apps4 years agoHow to Book an Ola or Uber Using Google Maps

-

Android Games4 years ago

LDPlayer vs Nox Player: Powerful Android Emulator for Gaming

-

Apps4 years ago

Apps4 years agoHow to Install WhatsApp Beta for Windows Mobile or Windows Phone

-

How to4 years ago

How to4 years agoJio Fiber Landline Service: How to Activate Jio Home Phone aka JioFixedVoice for Free Calling

-

How to4 years ago

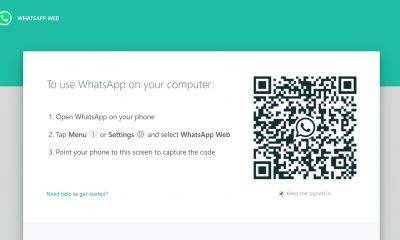

How to4 years agoWhatsApp Web: Everything You Need to Know

-

How to4 years ago

How to4 years agoHow to Increase Followers on Instagram for Real